UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Securities Exchange Act of 1934 (Amendment

(Amendment No. )

Filed by the Registrantþ

☒ Filed by a Party other than the Registrant¨ ☐

Check the appropriate box:

| Preliminary Proxy Statement | ||||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ☒ | Definitive Proxy Statement | |||

| ☐ | Definitive Additional Materials | |||

| ☐ | Soliciting Material Pursuant to | |||

UGI Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

UGI Corporation

| No fee required. | ||||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| ||||

(2) | Aggregate number of securities to which transaction applies:

| |||

| ||||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| ||||

(4) | Proposed maximum aggregate value of transaction:

| |||

| ||||

(5) | Total fee paid: | |||

| ||||

| Fee paid previously with preliminary materials. | ||||

| Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||||

| (1) | Amount Previously Paid:

| |||

| ||||

(2) | Form, Schedule or Registration Statement No.:

| |||

| ||||

(3) | Filing Party:

| |||

| (4) | ||||

| Date Filed:

| |||

| ||||

Notice of Annual Meeting and Proxy Statement Annual Meeting of Shareholders Wednesday, January 30, 2019 |

BOX 858 VALLEY FORGE, PA 19482 —610-337-1000

LON R. GREENBERGMARVIN O. SCHLANGER

Chairman

December 11, 201520, 2018

Dear Shareholder,

On behalf of our entire Board of Directors, I cordially invite you to attend our Annual Meeting of Shareholders on Thursday,Wednesday, January 28, 2016.30, 2019. At the meeting, we will review UGI’s performance for the 20152018 fiscal year and our expectations for the future.

I would like to take this opportunity to remind you that your vote is important. On December 11, 2015,20, 2018, we mailed our shareholders a notice containing instructions on how to access our 2015 proxy statement and annual report for the 2018 fiscal year and how to vote online. Please read the proxy materials and take a moment now to vote online or by telephone as described in the proxy voting instructions. Of course, if you received these proxy materials by mail, you may also vote by completing the proxy card and returning it by mail.

I look forward to seeing you on January 28th30th and addressing your questions and comments.

Sincerely,

Lon R. GreenbergMarvin O. Schlanger

BOX 858 VALLEY FORGE, PA 19482 —610-337-1000

December 11, 201520, 2018

NOTICEOF

ANNUAL MEETINGOF SHAREHOLDERS

The Annual Meeting of Shareholders of UGI Corporation will be held on Thursday,Wednesday, January 28, 2016,30, 2019, at 10:00 a.m., Eastern Standard Time, at The Desmond Hotel and Conference Center,Malvern, Ballrooms A and B, One Liberty Boulevard, Malvern, Pennsylvania. Shareholders will consider and take action on the following matters:items of business:

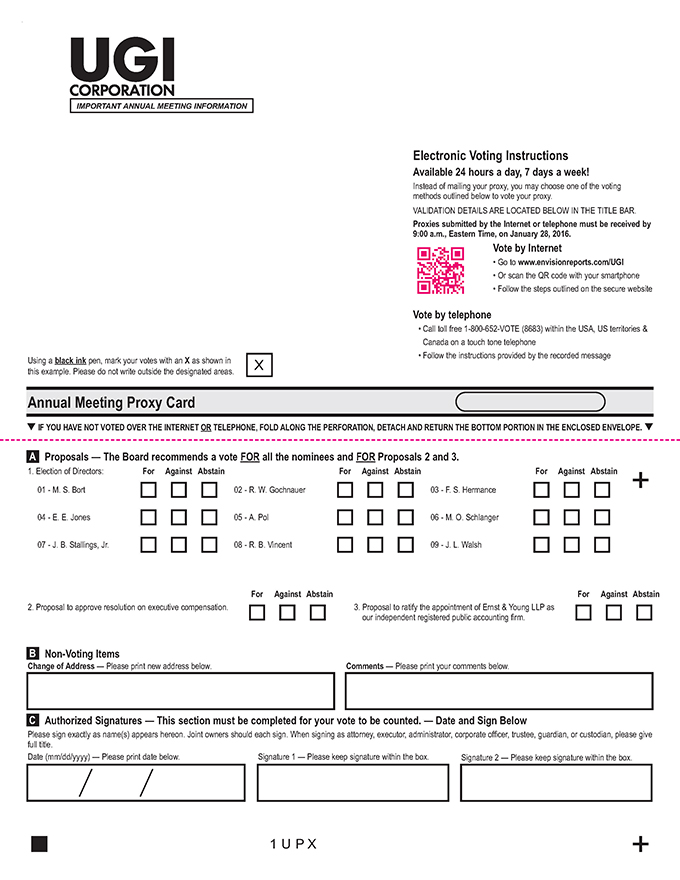

1. the election of nineten directors to serve until the next annual meeting of Shareholders;shareholders;

2. a non-bindingan advisory vote on a resolution to approve UGI Corporation’s executive compensation;

3. the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for Fiscal 2016;2019; and

4. the transaction of any other business that ismay properly raised atcome before the meeting.

Monica M. Gaudiosi

Corporate Secretary

Important Notice Regarding the Availability of Proxy Materials for the |

This Proxy Statement and the Company’s 20152018 Annual Report are available atwww.ugicorp.com.

|

| 1 | ||||

QUESTIONSAND ANSWERS A | ||||

| 6 | ||||

| 6 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 17 | ||||

STOCK OWNERSHIP GUIDELINESAND EQUITY PLAN LIMITSFOR INDEPENDENT DIRECTORS | 19 | |||

REPORTOFTHE COMPENSATIONAND MANAGEMENT DEVELOPMENT | ||||

EXECUTIVE COMPENSATION | ||||

COMPENSATIONOF EXECUTIVE OFFICERS – EXECUTIVE COMPENSATION TABLES | 44 | |||

| 60 | ||||

S | ||||

ITEM2 – ADVISORY VOTE O | ||||

ITEM3 – RATIFICATIONOF APPOINTMENTOF INDEPENDENT REGISTERED | ||||

This summary highlights information contained elsewhere in this Proxy Statement. The summary does not contain all of the information that you should consider. Please read the entire Proxy Statement carefully before voting.

Annual Meeting of Shareholders

Time and Date: | 10:00 a.m. (Eastern Standard Time), Wednesday, January | |

Place: | The Desmond One Liberty Boulevard, Malvern, Pennsylvania | |

Record Date: | November | |

Voting: | Shareholders as of the close of business on the record date are entitled to vote. Each share of common stock is entitled to one vote for each matter to be voted on. | |

Voting Matters and Board Recommendations

| Proposal | Required Approval | Board Recommendation | ||

Election of | Majority of Votes Cast | FOR |

| Majority of | FOR | ||

Ratification of Public Accounting Firm for | ||||

| FOR |

Corporate Governance and Executive Compensation Practices:How to Cast Your Vote

| Over the Internet | By Telephone | By Mail or in Person | ||

If your shares are registered in your name: Vote your shares over the Internet by accessing the Computershare proxy online voting website at: www.envisionreports.com/UGI and following theon-screen instructions. You will need the control number that appears on your Notice of Availability of Proxy Materials when you access the web page. If your shares are held in the name of a broker, bank or other nominee: Vote your shares over the Internet by following the voting instructions that you receive from such broker, bank or other nominee. | If your shares are registered in your name: Vote your shares over the telephone by accessing the telephone voting system toll-free at800-652-8683 and following voting instructions. The telephone instructions will lead you through the voting process. You will need the control number that appears on your Notice of Availability of Proxy Materials when you call. If your shares are held in the name of a broker, bank or other nominee: Vote your shares over the telephone by following the voting instructions you receive from such broker, bank or other nominee. | If you received these annual meeting materials by mail: Vote by signing and dating the proxy card(s) and returning the card(s) in the prepaid envelope. Shareholders may vote in person at the meeting. You may also be represented by another person at the meeting by executing a proper proxy designating that person. If you are a beneficial owner of shares, you must obtain a legal proxy from your broker, bank or other holder of record and present it to the Judge of Election with your ballot to be able to vote at the Meeting. |

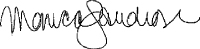

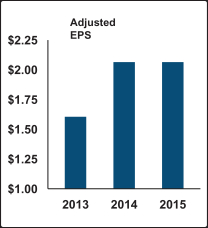

Performance Highlights – Fiscal 2018

The Board of Directors increased the annual dividend by approximately 4% (the 31st consecutive year of annual dividend increases).

Significant progress was made on growth projects during the fiscal year ended September 30, 2018 (“Fiscal 2018”), including (i) expansion of the Company’s geographic footprint in Italy, (ii) expansion of the Company’s liquefied natural gas liquefaction peaking capacity and (iii) enhancement of the Company’s natural gas infrastructure assets.

- 1 -

Advisory Vote to Approve Named Executive Officer Compensation

We are asking shareholders to approve, on an advisory basis, UGI Corporation’s executive compensation, including our executive compensation policies and practices and the compensation of our named executive officers, as described in this Proxy Statement beginning on page 20.

| Proposal | Discussion | Board Recommendation | ||

| We are asking shareholders to approve, on an advisory basis, the Company’s executive compensation, including our executive compensation policies and practices and the compensation of our named executive officers, as described in this Proxy Statement beginning on page 63. | At our |

This result clearly demonstrated strong support for our executive compensation policies and practices and the alignment of executive pay to Company performance.officers.

This result clearly demonstrated strong support for our executive compensation policies and practices and the alignment of | FOR Our Board recommends aFORvote |

Objectives and Components of Our Compensation Program

| Objectives | Components | |

The compensation program for our named executive officers is designed to provide a competitive level of total compensation necessary to attract and retain talented and experienced executives. Additionally, our compensation program is intended to motivate and encourage our executives to contribute to our success and reward our executives for leadership excellence and performance that promotes sustainable growth in shareholder value. | In Fiscal 2018, the components of our executive compensation program included salary, annual bonus awards, long-term incentive compensation (performance unit awards and UGI Corporation stock option grants), discretionary bonus awards, limited perquisites, retirement benefits and other benefits, all as described in greater detail in the Compensation Discussion and Analysis of this Proxy Statement. We believe that the elements of our compensation program are essential components of a balanced and competitive compensation program to support our annual and long-term goals. |

In Fiscal 2015, the components of our executive compensation program included salary, annual bonus awards, long-term incentive compensation (performance unit awards and UGI Corporation stock option grants), limited perquisites, retirement benefits and other benefits, all as described in greater detail in the Compensation Discussion and Analysis of this Proxy Statement. We believe that the elements of our compensation program are essential components of a balanced and competitive compensation program to support our annual and long-term goals.

Pay for Performance

Our executive compensation program allows the Compensation and Management Development Committee and the Board to determine pay based on a comprehensive view of quantitative and qualitative factors designed to enhance shareholder value and align the long-term interests of executives and shareholders.

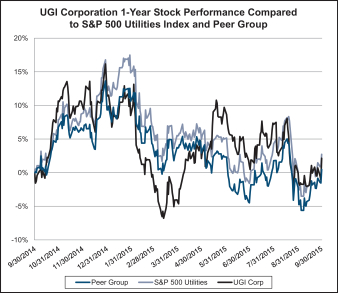

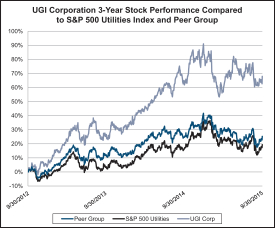

For example, for the 2012-2014 performance period, UGI Corporation’s total shareholder return compared to its peer group was in the 97th percentile and Mr. Walsh received a performance unit payout of $3,036,515 during Fiscal 2015. For the 2011-2013 performance period, UGI Corporation’s total shareholder return compared to its peer group was in the 50th percentile and Mr. Walsh received a performance unit payout of $1,250,970 during Fiscal 2014. For additional information on the alignment between our financial results and executive officer compensation, see the Compensation Discussion and Analysis.

- 2 -

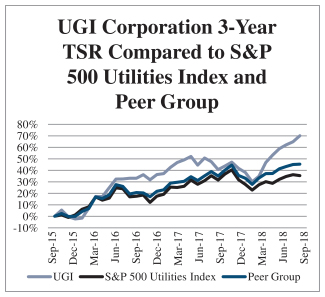

Our executive compensation program allows the Compensation and Management Development Committee and the Board to determine pay based on a comprehensive view of quantitative and qualitative factors designed to enhance shareholder value and align the long-term interests of executives and shareholders. We believe that the performance-based components of our compensation program, namely our stock options and performance units, have effectively linked our executives’ compensation to our financial performance. The Company allocates a substantial portion of compensation to performance-based compensation. In Fiscal 2018, 81% of the principal compensation components, in the case of Mr. Walsh, and 63% to 71% of the principal compensation components, in the case of all other | named executive officers, except for Mr. Oliver, were variable and tied to financial performance. For example, for the 2015-2017 performance period, UGI Corporation’s total shareholder return compared to its peer group was in the 41st percentile (UGI ranked 20th out of the 33 companies in its peer group) and Mr. Walsh received a performance unit payout equal to 71.9% of target in Fiscal 2018. For the 2016-2018 performance period (estimated as of October 31, 2018), UGI Corporation’s total shareholder return compared to its peer group was in the 90th percentile and Mr. Walsh would receive a performance unit payout equal to 199.1% of target in Fiscal 2019. For additional information on the alignment between our financial results and executive officer compensation, see the Compensation Discussion and Analysis in this Proxy Statement. |

Corporate Governance and Executive Compensation Practices

| Corporate Governance | Executive Compensation | |

✓Annual election of directors ✓Majority voting with a director resignation policy for directors not receiving a majority of votes cast in uncontested elections ✓The Board is led by an independent chairman ✓Majority of directors are independent (8 of 9) ✓Regularly scheduled executive sessions ofnon-management directors ✓Independent Board Committees (except for the Executive Committee), each with authority to retain independent advisors ✓Compensation and Management Development Committee advised by independent compensation consultant ✓Annual Board and Committee self-assessment process, utilizing assistance of outside counsel ✓No supermajority voting provisions ✓Annual limit of $500,000 on individual director equity awards ✓Meaningful director stock ownership requirements ✓Mandatory retirement age of 75 years for directors | ✓Meaningful executive officer stock ownership requirements ✓Policy against hedging and pledging of Company securities by directors and executive officers ✓Termination of employment is required for payment underchange-in-control agreements (“double trigger”) ✓Double trigger for the accelerated vesting of equity awards in the event of a change in control ✓A substantial portion of executive compensation is allocated to performance-based compensation, including long-term awards, in order to align executive officers’ interests with shareholders’ interests and to enhance long-term performance (81% of the principal components, in the case of Mr. Walsh, and 63% to 71% in the case of all other named executive officers, except for Mr. Oliver) ✓Recoupment policy for incentive-based compensation paid or awarded to current and former executive officers in the event of a restatement of financial results due to materialnon-compliance with any financial reporting requirement ✓Board-reviewed succession plan for CEO and other senior management |

QUESTIONS AND ANSWERS ABOUT PROXY MATERIALS, ANNUAL MEETING AND VOTING |

This proxy statement contains information related to the Annual Meeting of Shareholders of UGI Corporation (the “Company”) to be held on Thursday,Wednesday, January 28, 2016,30, 2019, beginning at 10:00 a.m., Eastern Standard Time, at The Desmond Hotel and Conference Center,Malvern, Ballrooms A and B, One Liberty Boulevard, Malvern, Pennsylvania, and at any postponements or adjournments thereof. Directions to The Desmond Hotel and Conference CenterMalvern appear on page 61.65. This proxy statement was prepared under the direction of the Company’s Board of Directors to solicit your proxy for use at the Annual Meeting. It was made available to shareholders on or about December 11, 2015.20, 2018.

Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of printed proxy materials?

The Company has elected to provide access to the proxy materials over the Internet. We believe that this initiative enables the Company to provide proxy materials to shareholders more quickly, reduces the impact of our Annual Meeting on the environment and reduces costs.

Who is entitled to vote?

Only shareholders of record at the close of business on November 12, 2015,13, 2018, the record date, are entitled to vote at the Annual Meeting. On November 12, 2015,13, 2018, there were 172,510,091173,846,575 shares of common stock outstanding. Each shareholder has one vote per share on all matters to be voted on.

What am I voting on?

You are voting on:

How do I vote?

Voting instructions appear on the proxy card. You may vote in one of three ways:

Over the Internet

If your shares are registered in your name: Vote your shares over the Internet by accessing the Computershare proxy online voting website at: www.envisionreports.com/UGI and following the on-screen instructions. You will need the control number that appears on your Notice of Availability of Proxy Materials when you access the web page.

If your shares are held in the name of a broker, bank or other nominee: Vote your shares over the Internet by following the voting instructions that you receive from such broker, bank or other nominee.

By Telephone

If your shares are registered in your name: Vote your shares over the telephone by accessing the telephone voting system toll-free at 800-652-8683 and following the telephone voting instructions. The telephone instructions will lead you through the voting process. You will need the control number that appears on your Notice of Availability of Proxy Materials when you call.

If your shares are held in the name of a broker, bank or other nominee: Vote your shares over the telephone by following the voting instructions you receive from such broker, bank or other nominee.

By Mail

If you received these annual meeting materials by mail: Vote by signing and dating the proxy card(s) and returning the card(s) in the prepaid envelope. Also, you can vote online or by using a toll-free telephone number.

- 3 -

How can I vote my shares held in the Company’s Employee Savings Plans?

You can instruct the trustee for the Company’s Employee Savings Plans to vote the shares of stock that are allocated to your account in the UGI Stock Fund. If you do not vote your shares, the trustee will vote them in proportion to those shares for which the trustee has received voting instructions from participants.

How can I change my vote?

You can change or revoke your vote at any time before polls close at the 20162019 Annual Meeting:

If you returned a paper proxy card, you can write to the Company’s Corporate Secretary at our principal offices,office, 460 North Gulph Road, King of Prussia, Pennsylvania 19406, stating that you wish to revoke your proxy and that you need another proxy card.

You can vote again, either over the Internet or by telephone.

If you hold your shares through a broker, bank or other nominee, you can revoke your proxy by contacting the broker, bank or other nominee and follow its procedure for revocation.

contacting the broker, bank or other nominee and following its procedure for revocation. |

If you attend the meeting, you may vote by ballot, which will cancel your previous proxy vote. However, if your shares are held through a broker, bank or other nominee, and you wish to vote by ballot at the meeting, you will need to contact your bank, broker or other nominee to obtain a legal proxy form that you must bring with you to the meeting to exchange for a ballot.

Your last vote is the vote that will be counted.

What is a quorum?

A “quorum” is the presence at the meeting, in person or represented by proxy, of the holders of a majority of the outstanding shares entitled to vote. A quorum of the holders of the outstanding shares must be present for the Annual Meeting to be held. Abstentions and brokernon-votes are counted for purposes of determining the presence or absence of a quorum.

How are votes, abstentions and brokernon-votes counted?

Abstentions and brokernon-votes are counted for purposes of determining the presence or absence of a quorum, but are not considered a vote cast under Pennsylvania law.

When a broker, bank or other nominee holding shares on your behalf does not receive voting instructions from you, the broker, bank or other nominee may vote those shares only on matters deemed “routine” by the New York Stock Exchange. Onnon-routine matters, the broker, bank or other nominee cannot vote those shares unless they receive voting instructions from the beneficial owner. A “brokernon-vote” means that a broker has not received voting instructions and either declines to exercise its discretionary authority to vote on routine matters or is barred from doing so because the matter isnon-routine.

As a result, abstentions and brokernon-votes are not included in the tabulation of the voting results on issues requiring approval of a majority of the votes cast and, therefore, do not have the effect of votes in opposition in such tabulation.

What vote is required to approve each item?

The director-nominees will be elected by a majority of the votes cast at the Annual Meeting.

| • | Election of Directors:Majority of Votes Cast |

Under the Company’sour Bylaws and Principles of Corporate Governance, Directors must be elected by a majority of the votes cast in uncontested elections, such as the election of Directors at the Annual Meeting. This means that a director-nominee will be elected to the Company’sour Board of Directors if the votes cast “FOR” such Director nominee exceed the votes cast “AGAINST” him or her. In addition, an incumbent Director will be required to tender his or her resignation if a majority of the votes cast are not in his or her favor in an uncontested election of Directors. The Corporate Governance Committee would then be required to recommend to the Board of Directors whether to accept the incumbent Director’s resignation, and the Board will have ninety (90) days from the date of the election to determine whether to accept such resignation.

- 4 -

| • | Advisory Approval of Executive Compensation:Majority of Votes Cast |

The approval, by advisory vote, of the Company’s executive compensation requires the affirmative vote of a majority of the shares present in person or by proxy and entitled to vote at the 20162019 Annual Meeting. This vote is advisory in nature and therefore not binding on UGI Corporation, the Board of Directors or the Compensation and Management Development Committee. However, our Board of Directors and the Compensation and Management Development Committee value the opinions of the Company’sour shareholders and will consider the outcome of this vote in their future deliberations on the Company’s executive compensation programs.

| • | Ratification of the selection of Ernst & Young LLP:Majority of Votes Cast |

The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for Fiscal 20162019 requires the affirmative vote of a majority of the votes cast at the meeting to be approved.

Who will count the vote?

Representatives of Computershare Inc., our Transfer Agent, will tabulate the votes cast by proxy or in person at the Annual Meeting.Meeting and act as inspectors of election.

What are the deadlines for Shareholder proposals for next year’s Annual Meeting?

Shareholders may submit proposals on matters appropriate for shareholder action as follows:

Shareholders who wish to include a proposal in the Company’s proxy statement for the 20172020 annual meeting must comply in all respects with the rules of the U.S. Securities and Exchange

Commission (“SEC”) relating to such inclusion and must submit the proposals |

If any shareholder wishes to present a proposal at the 2020 Annual Meeting that is not included in our proxy statement for that meeting, the proposal must be received by the Corporate Secretary at the above address by November 5, 2019. For proposals that are not received by November 5, 2019, the proxy holders will have discretionary authority to vote on the matter without including advice on the nature of the proposal or on how the proxy holders intend to vote on the proposal in our proxy statement.

All proposals and notifications should be addressed to the Corporate Secretary at our principal office, 460 North Gulph Road, King of Prussia, Pennsylvania 19406.

How much did this proxy solicitation cost?

The Company has engaged Georgeson Inc. to solicit proxies for the Company for a fee of $7,500 plus reasonable expenses for additional services. We also reimburse banks, brokerage firms and other institutions, nominees, custodians and fiduciaries for their reasonable expenses for sending proxy materials to beneficial owners and obtaining their voting instructions. Certain Directors, officers and regular employees of the Company and its subsidiaries may solicit proxies personally or by telephone or facsimile without additional compensation.

- 5 -

| |

NineTen directors have been nominated by the Board of Directors to stand for election as directors at the Annual Meeting of Shareholders based upon recommendations from the Corporate Governance Committee. Each director-nominee has consented to serve, if elected, until the next annual meeting or until his or her earlier resignation or removal. If any director-nominee is not available for election, proxies will be voted for another person nominated by the Board of Directors or the size of the Board will be reduced. Other than James B. Stallings, Jr.,Alan N. Harris, who was elected by the Board of Directors to serve as a Director effective September 28, 2015,March 5, 2018, and Kelly A. Romano, who was nominated by the Board of Directors to stand for election at the 2019 Annual Meeting of Shareholders, all of the director-nominees were elected to the Board by our shareholders.shareholders at last year’s annual meeting. The Board of Directors has unanimously nominated M. Shawn Bort, (formerly Puccio),Theodore A. Dosch, Richard W. Gochnauer, Alan N. Harris, Frank S. Hermance, Ernest E. Jones, Anne Pol, Kelly A. Romano, Marvin O. Schlanger, James B. Stallings, Jr., Roger B. Vincent and John L. Walsh for re-electionelection as directors at the Annual Meeting. Lon R. Greenberg previously announced his intention to retire as the Non-Executive Chairman of the Company’s Board of Directors effective as of the 2016 Annual Meeting of Shareholders on January 28, 2016.

Information about Director-Nominees

ForBiographical information for each of the director-nominees standing for re-election,election is set forth below, is biographical information, as well as a description of the specific experience, qualifications, attributes and skills that led the Board to conclude that, in light of the Company’s business and structure, the individual should serve as a director. The Board believes that each director-nominee has valuable individual skills and experience that, taken as a whole, provide the depth of knowledge, judgment and strategic vision necessary to provide effective oversight of the Company.

The Board of Directors recommends that you vote “FOR” the election of each of the |

| M. SHAWN BORT Retired Senior Vice President, Finance, Saint-Gobain Corporation

Director since 2009 Age

| |

Principal Occupation and Business Experience: Ms. Bort wasretired in 2015 as Senior Vice President, Finance of Saint-Gobain Corporation, the North American business of Compagnie de Saint-Gobain (a global manufacturer and distributor of flat glass, building products, glass containers and high performance materials) from 2006 until her retirement in May 2015.(2006 to 2015). Ms. Bort was formerly Vice President, Finance (2005 to 2006) and Vice President, Internal Control Services (2002 to 2005) of Saint-Gobain. Prior to joining Saint-Gobain, she was a partner with PricewaterhouseCoopers LLP, a public accounting firm (1997 to 2002), having joined Price Waterhouse in 1984. Ms. Bort also serves as a Director of UGI Utilities, Inc., a subsidiary of the Company.

Key Skills and Qualifications: Ms. Bort’s qualifications to serve as a director include her senior financial executive management experience with a global company, andas well as her extensive public accounting knowledge and experience. Her education (Ms. Bort has a bachelor’s degree in accounting from Marquette University and a Master of Business Administration degree in finance and operations management from the Wharton School of the University of Pennsylvania) and experience provide her with financial expertise and a well-developed awareness of IT infrastructure, financial strategy, asset management and risk management. Ms. Bort also possesses international experience by virtue of her former executive position at a large global company.company and corporate governance experience by virtue of her position on the advisory board at Drexel University’s LeBow College of Business, Center for Corporate Governance.

- 6 -

| THEODORE A. DOSCH Executive Vice President of Finance and Chief Financial Officer, Anixter International Inc. Director since 2017 Age 59 Member, Audit Committee | |

Principal Occupation and Business Experience: Mr. Dosch is Executive Vice President of Finance and Chief Financial Officer of Anixter International Inc. (a leading global distributor of network & security solutions, electrical & electronic solutions and utility power solutions) (since 2011). He previously served as Anixter International’s Senior Vice President, Global Finance (2009 to 2011). Prior to joining Anixter International, Mr. Dosch held a number of executive positions with Whirlpool Corporation, including CFO – North America and Vice President of Maytag Integration (2006 to 2008), Corporate Controller (2004 to 2006) and CFO – North America (1999 to 2004). Mr. Dosch also serves as a Director of UGI Utilities, Inc., a subsidiary of the Company.

Key Skills and Qualifications: Mr. Dosch’s qualifications to serve as a director include his senior financial executive management experience at both Anixter International and Whirlpool Corporation. His education (Mr. Dosch has a bachelor’s degree in accounting from Ohio University and is a certified public accountant) and experience provide him with financial expertise. Mr. Dosch possesses extensive international expertise by virtue of his positions at Anixter International and Whirlpool Corporation, companies with global operations, as well asin-depth experience in the areas of strategic planning, asset management, and risk management.

| RICHARD W. GOCHNAUER Retired Chief Executive Officer, United Stationers, Inc.

Director since 2011 Age

Member, Member, Corporate Governance Committee |

Principal Occupation and Business Experience: Mr. Gochnauer retired in May 2011 as Chief Executive Officer and Director of United Stationers, Inc. (a wholesale distributor of business products) (2002 to 2011). He previously served as President and Chief Operating Officer and Vice Chairman and President, International, of Golden State Foods Corporation (a diversified international supplier to the food service industry supplier)industry) (1994 to 2002). Mr. Gochnauer also serves as a Director of AmerisourceBergen Corporation (a wholesale distributor of business products in the U.S. and internationally), Golden State Foods Corporation, (a diversified supplier to the foodservice industry), and UGI Utilities, Inc., a subsidiary of the Company.Company, and Vodori (a private marketing solutions company).

Key Skills and Qualifications: Mr. Gochnauer’s qualifications to serve as a director include his extensive senior management experience as Chief Executive Officer of a large public company and his operational, strategic planning, technology, and business development expertise. Mr. Gochnauer’sGochnauer is also able to offer significant insights in the areas of international operations, logistics and distribution, government regulation and corporate governance.

| ALAN N. HARRIS Retired Senior Advisor and Chief Development and Operations Officer Spectra Energy Corporation Director since 2018 Age 65 Member, Safety, Environmental and Regulatory Compliance Committee |

Principal Occupation and Business Experience: Mr. Harris retired in January 2015 from Spectra Energy Corporation (an operator in the transmission and storage, distribution and gathering and processing of natural gas) where he served in multiple roles since 2007, including as Senior Advisor to the Chairman, President and Chief Executive Officer on project execution efforts (January 2014 to January 2015), Chief Development Officer and Chief Operations Officer (2008 to 2014) and Chief Development Officer (2007 to 2008). Prior to Spectra Energy Corporation’sspin-off from Duke Energy Gas Transmission, Mr. Harris held various positions of increasing responsibility at Duke Energy, including Group Vice President, Chief Financial Officer (2004 to 2006), Executive Vice President (2003 to 2004), Senior Vice President, Strategic Development and Planning (2002 to 2003), Vice President, Controller, Treasurer, Strategic Planning (2000 to 2002) and Vice President, Controller, Strategic Planning (1999 to 2000). Mr. Harris currently serves as a Director of Enable Midstream Partners, LP (an owner, operator and developer of midstream energy infrastructure assets in the United States) and UGI Utilities, Inc., a subsidiary of the Company.

Key Skills and Qualifications: Mr. Harris’ extensive background in the energy industry, and in particular natural gas distribution and transmission, provide him with industry expertise. Additionally, Mr. Harris’ experience provides him with strategic planning and business development experience. As a former senior financial executive, Mr. Harris also possesses experience in corporate finance and accounting. His education (Mr. GochnauerHarris has a Bachelor of Sciencebachelor’s degree in accounting from NorthwesternNortheastern Oklahoma State University and an MBA from the University of Tulsa and is a Master of Business Administration from Harvard University)certified public accountant) and experience provide him with financial expertise. Mr. Harris also possesses operational expertise in the energy sector by virtue of his senior executive experience at Spectra Energy and his director experience at Enable Midstream Partners.

| FRANK S. HERMANCE Retired Chairman and

Director since 2011 Age

Chair, Safety, Environmental and Regulatory Compliance Committee Member, Compensation and Management Development Committee Member, Corporate Governance Committee | |

Principal Occupation and Business Experience: Mr. Hermance is the retired Chairman of the Board (since 2001)(2001 to 2017) and Chief Executive Officer (since 1999)(1999 to 2016) of AMETEK, Inc. (a global manufacturer of electronic instruments and electromechanical devices). He previously served as AMETEK’s President and Chief Operating Officer of AMETEK, Inc. (1996 to 1999). Mr. Hermance isalso serves as a Director of AmeriGas Propane, Inc. and UGI Utilities, Inc., both of which are subsidiaries of the Company, as Director Emeritus of the Greater Philadelphia Alliance for Capital and Technologies, as Vice Chairman of the World Affairs Council of Philadelphia, and as an advisory board member at American Securities LLP (a private equity firm). He previously served as a member of the Board of Trustees of the Rochester Institute of Technology. He also serves as a Director of UGI Utilities, Inc., a subsidiary of the Company,Technology (until November 2016).

Key Skills and as a Director of the Greater Philadelphia Alliance for Capital and Technologies. He previously served as a Director of IDEX Corporation, ending in April 2012.

Qualifications: Mr. Hermance’s qualifications to serve as a director include his extensive senior management experience in the roles of Chairman, Chief Executive Officer, President and Chief Operating Officer of a large global public company. The Board also considered Mr. Hermance also providesHermance’s relevant

experience in the areas of corporate governance, mergers and acquisitions, human resources management,international operations, logistics, distribution, risk management, mergers and acquisitions, corporate governance, human resources management and executive compensation. As an executive of a company with global operations, Mr. Hermance also provides the Board with international experience.

- 7 -

|

| |

Mr. Jones is President of EJones Consulting, LLC (since 2011) (a company that provides management consulting services to non-profit organizations). He retired from his position as President and Chief Executive Officer of Philadelphia Workforce Development Corporation (an agency that funds, coordinates and implements employment and training activities in Philadelphia, Pennsylvania) in 2010, having served in that capacity since 1998. He formerly served as President and Executive Director of the Greater Philadelphia Urban Affairs Coalition (1983 to 1998) and as Executive Director of Community Legal Services, Inc. (1977 to 1983). Mr. Jones also serves as a Director of the African American Museum in Philadelphia, the Philadelphia Contributionship, Vector Security, Inc. and UGI Utilities, Inc., a subsidiary of the Company. He previously served as a Director of PARADIGM Global Advisors LLC and Thomas Jefferson University.

Mr. Jones’ qualifications to serve as a director include his extensive experience managing government and non-profit organizations as Chief Executive Officer, his public and private company directorship experience and his insight into workforce, compensation, regulatory, banking and legal issues. Mr. Jones possesses a critical understanding of the Company’s business operations, strategic growth opportunities, and corporate governance matters.

| ANNE POL Retired President and Chief Operating Officer, Trex Enterprises Corp.

Director 1993 through 1997 and since 1999 Age

Member, Safety, Environmental and Regulatory Compliance Committee Member, Executive Committee | |

Principal Occupation and Business Experience: Mrs. Pol retired in 2005 as President and Chief Operating Officer of Trex Enterprises Corporation (a high-technology research and development company), a position she had held since 2001. She previously served as Senior Vice President (1998 to 2001) and Vice President (1996 to 1998) of Thermo Electron Corporation (an environmental monitoring and analytical instruments company and a major producer of recycling equipment, biomedical products and alternative energy systems). Mrs. Pol also served as President of Pitney Bowes Shipping and Weighing Systems Division, a business unit of Pitney Bowes Inc. (a mailing and related business equipment company) (1993 to 1996); Vice President of New Product Programs in the Mailing Systems Division of Pitney Bowes Inc. (1991 to 1993); and Vice President of Manufacturing Operations in the Mailing Systems Division of Pitney Bowes Inc. (1990 to 1991). Mrs. Pol also serves as a Director of UGI Utilities, Inc. and AmeriGas Propane, Inc., both of which are subsidiaries of UGI Corporation.

Key Skills and Qualifications: Mrs. Pol’s qualifications to serve as a director include her strategic planning, business development and technology experience as a senior-level executive with a diversified high-technology company. Mrs. Pol also possesses an important understanding of, and extensive experience in, the areas of executive compensation, human resource management, corporate governance and government regulation.

The Board also considered Mrs. Pol’s intimate knowledge and understanding of the Company’s businesses by virtue of her years serving as a director of the Company.

- 8 -

| KELLY A. ROMANO Founder and Chief Executive Officer, Blueripple Capital, LLC Director Nominee Age 56 | |

Principal Occupation and Business Experience:Ms. Romano is the Founder and Chief Executive Officer of BlueRipple Capital, LLC, a consultancy firm focused on strategy, acquisitions, deal structure, and channel development for high technology companies. Ms. Romano retired from United Technologies Corporation (a diversified company that provides high technology products and services to the building and aerospace industries) in 2016 after serving in various positions of increasing responsibility since 1984. From 1993 to 2016, Ms. Romano held a number of senior executive positions at United Technologies Corporation, including President, Intelligent Building Technologies, Building Systems & Services (September 2014 to April 2016), Corporate Vice President, Business Development, UTC Corporate Headquarters (March 2012 to September 2014), President, Global Security Products, UTC Fire & Security (May 2011 to February 2012), Senior Vice President, Global Sales & Marketing, UTC Fire & Security (January 2010 to April 2011), and President, Building Systems & Services, Carrier Corporation (January 2006 to December 2009). Ms. Romano has been an executive advisory board member of Gryphon Investors (a private equity firm

focused on middle-market investment opportunities) since December 2016; a senior advisory partner of Sand Oak Capital Partners, LLC (a private equity firm focused on investments in industrial and manufacturing companies in the U.S.) since May 2016; managing partner of Xinova, LLC (an innovation development and banking firm) since May 2016; and a director andco-chair of the Board of Potter Electric Signal (a leading sprinkler monitoring and fire-life safety company) since December 2017. Ms. Romano is currently a director of Dorman Products, Inc.

Key Skills and Qualifications: Ms. Romano’s qualifications to serve as a director include her extensive global senior management experience at United Technologies Corporation and her operational, technology, sales, marketing, distribution, strategic planning and leadership, business development, corporate governance, and executive compensation knowledge and expertise.

| MARVIN O. SCHLANGER Principal, Cherry Hill Chemical Investments, L.L.C.

Director since 1998 Age

Chair, Chair, Executive Committee

|

Principal Occupation and Business Experience: Mr. Schlanger serves as the Company’s Chairman of the Board (since January 2016). He is a Principal in the firm of Cherry Hill Chemical Investments, L.L.C. (a management services and capital firm for chemical and allied industries) (since 1998). Mr. Schlanger served as Chief Executive Officer of CEVA Holdings BV and CEVA Holdings, LLC, an international logistics supplier (2012 to 2013). As previously announced, Mr. Schlanger has been elected to serve as Chairman of the Board, effective upon Mr. Greenberg’s retirement, and subject to his election as a Director at the Company’s Annual Meeting of Shareholders. Mr. Schlanger is currently a director of AmeriGas Propane, Inc., and UGI Utilities, Inc., both of which are subsidiaries of UGI Corporation. He is also a director of CEVA Holdings, LLC, where he serves as chairman,Logistics AG, Hexion, Inc., and Momentive Performance Materials, Inc., and VECTRA Company. Mr. Schlanger also serves on the advisory board of the Kleinman Center for Energy Policy at the University of Pennsylvania. He previously served as a director of CEVA Holdings, LLC (2009 to 2018) and CEVA Group, plc (2009 to 2018).

Key Skills and Qualifications: Mr. Schlanger’s qualifications to serve as a director include his senior management, strategic planning, business development, risk management, and general operationsoperational experience. Additionally, by virtue of his experience throughout his career as Chief Executive Officer, Chief Operating Officer, and Chief Financial Officer of ArcoARCO Chemical Company, a large public company. By virtue ofcompany, and his senior executive leadership at companies with global operations, Mr. Schlanger also provides the Board with international experience. The Board also considered Mr. Schlanger’s experience serving as chairman, director and committee member on the boards of directors of large public and private international companies.companies, Mr. Schlanger also possessesin-depth knowledge in the areas of executive compensation, corporate governance and international operations. The Board also considered Mr. Schlanger’s intimate knowledge and understanding of the Company’s businesses by virtue of his years serving as a director of the Company.

| JAMES B. STALLINGS, JR.

Director since 2015 Age Member, Audit Committee Member, Safety, Environmental and Regulatory Compliance Committee | |

Principal Occupation and Business Experience: Mr. Stallings is Managing Partnerthe Chief Executive Officer of PS27 Ventures, LLC, a private investment fund focused on technology companies (since January 2013). Mr. Stallings retired from International Business Machines Corporation (IBM) (a global provider of information technology and services) as General Manager of Global Markets, Systems and Technology, a position he had held since 2009. From 2002 to 2009, Mr. Stallings held a number of senior executive leadership positions at IBM in the technology, mainframe, software and intellectual property areas. He was founder, Chairman and CEO of E House (a consumer technology company) from 2000 to 2002. Previously he was Executive Vice President, Physician Sales & Services, Inc. (a medical products supplier) from 1996(1996 to 2000.2000). Mr. Stallings currently serves as a director of Fidelity National Information Services Corporation (FIS) (a global provider of banking and payment technology, consulting and outsourcing solutions), Cannae Holdings, Inc. (a principal investment firm) and as a director of UGI Utilities, Inc., a subsidiary of the Company.

Key Skills and Qualifications: Mr. Stallings’ qualifications to serve as a director include his expertise and extensive experience managing enterprise-wide global technology and information systems, including responsibility for profit and loss statements. With Mr. Stallings’ combination of business development and technology infrastructure expertise, as well as his education (Mr. Stallings has a Bachelor of Science degree from the U.S. Naval Academy) and his service as a director on other boards, he provides valuable business development, board-level risk management oversight (including with respect to a regulated industry), finance experience and corporate governance. The Board also considered his strong leadership, operations experience and strategic planning, and business development expertise, as well as his investment committee experience at a venture capital company. By virtue of his other board service, Mr. Stallings possesses experience with board-level risk oversight, corporate governance and banking issues.

- 9 -

|

| |

Mr. Vincent retired in 2011 from his position as President of Springwell Corporation, a corporate finance advisory firm he founded in 1989. Prior to 1989, Mr. Vincent held various positions at Bankers Trust Company, including managing director. Mr. Vincent serves as Trustee and Former Chairman of the Board of the VOYA Funds and as a Director of UGI Utilities, Inc., a subsidiary of the Company. He previously served as a Director of AmeriGas Propane, Inc., a subsidiary of the Company, from 1998 to 2006.

Mr. Vincent’s qualifications to serve as a director include his extensive experience as founder and senior executive of a corporate finance advisory firm, as well as his prior experience as a managing partner at a major banking institution. In addition, the Board considered Mr. Vincent’s many years serving as a director and trustee at various funds of a registered investment company, his service as a member or chair of the audit committees for public companies and funds, and his investment banking, capital market and financial expertise. Mr. Vincent’s education (Mr. Vincent has a bachelor’s degree in mathematics and engineering from Yale University and a Master of Business Administration degree with a concentration in finance from Harvard University) and experience provide him with financial expertise.

| JOHN L. WALSH President and Chief Executive Officer

Director since 2005 Age

Member, Executive Committee | |

Principal Occupation and Business Experience: Mr. Walsh is a Director and President (since 2005) and Chief Executive Officer (since 2013) of UGI Corporation. In addition, Mr. Walsh serves as a Director (since 2005) and Vice Chairman of the Board of AmeriGas Propane, Inc. (since 2005)2016) where he had served as a director and vice chairman since 2005. He also serves as a Director and Vice Chairman of UGI Utilities, Inc. (since 2005), both of which. Both AmeriGas Propane, Inc. and UGI Utilities, Inc. are subsidiaries of UGI Corporation. Mr. Walsh served as Chief Operating Officer of UGI Corporation (2005-2013)(2005 to 2013) and as President and Chief Executive Officer of UGI Utilities, Inc. (2009 to 2011). Previously, Mr. Walsh was the Chief Executive of the Industrial and Special Products Divisiondivision of the BOC Group plc (an industrial gases company), a position he assumed in 2001. He was an Executive Director of BOC (2001 to 2005), having joined BOC in 1986 as Vice President – Special Gases and having held various senior management positions in BOC, including President of Process Gas Solutions, North America (2000 to 2001) and President of BOC Process Plants (1996 to

2000). Mr. Walsh also serves as a Vice PresidentDirector at Main Line Health, Inc., the United Way of Greater Philadelphia and Director ofSouthern New Jersey, the World LPG Association.Affairs Council of Philadelphia, the Greater Philadelphia Chamber of Commerce, the Satell Institute, and the Philadelphia Zoo, and as Trustee at the Saint Columbkille Partnership School.

Key Skills and Qualifications: Mr. Walsh’s qualifications to serve as a director include his extensive strategic planning, logistics and distribution and operational experience and his executive leadership experience as the Company’s CEOPresident and President,Chief Executive Officer, as well as his previous service as the Company’s Chief Operating Officer, and his other prior senior management experience with a global public company. Mr. Walsh hasin-depth knowledge of the Company’s businesses, competition, risks and health, environmental and safety issues. Mr. Walsh, by virtue of his current position and his previous position at a multinational industrial gas company, possesses international experience, as well as management development and compensation experience.

- 10 -

| |

Corporate Governance Principles

The business of UGI Corporation is managed under the direction of the Board of Directors. As part of its duties, the Board oversees the corporate governance of the Company for the purpose of creating and sustaining long-term value for its shareholders and safeguarding its commitment to its other stakeholders: our employees, our customers, our suppliers, andvendors, creditors, and the communities in which we do business. To accomplish this purpose, the Board considers the interests of the Company’s shareholdersstakeholders when, together with management, it sets the strategies and objectives of the Company.

The Board, recognizing the importance of good corporate governance in carrying out its responsibilities to our shareholders, has adopted the UGI Corporation Principles of Corporate Governance. The Principles of Corporate Governance provide a framework for the effective governance of the Board and the Company by outlining the responsibilities of the Board and Board Committees. The Board, upon recommendation of the Corporate Governance Committee, regularly reviews the Principles and, as appropriate, updates them in response to changing regulatory requirements, feedback from shareholders on governance matters and evolving best practices in corporate governance.

The full text of the Company’s Principles of Corporate Governance can be found on the Company’s website,www.ugicorp.com,, under Investor Relations, Corporate Governance or in print, free of charge, upon written request.

The Board has determined that, other than Mr. Walsh, no Director has a material relationship with the Company, and each Director satisfies the criteria for an “independent director” under the rules of the New York Stock Exchange.

The Board has established the following additional guideline to assist it in determining director independence:

if a director serves as an officer, director or trustee of anon-profit organization, charitable contributions to that organization by the Company and its affiliates that do not exceed the greater of $1,000,000 or two percent of the charitable organization’s total revenues per year will not be considered to result in a material relationship between such director and the Company.

In making its determination of independence, the Board, with the assistance of the Company’s legal counsel, considered charitable contributions and ordinary business transactions between the Company, or affiliates of the Company, and companies where our Directors are employed or serve as directors, all of which were in compliance with either the independence rules of the New York Stock Exchange or the categorical standard set by the Board of Directors for determining director independence.

Board Leadership Structure and Role in Risk Management

The Board of Directors regularly assesses and determines the most appropriate Board structure to ensure effective and independent leadership while also ensuring appropriate insight into the operations and strategic direction of the Company. At the time Mr. Greenberg announced his intention to retire as Non-Executive Chairman of the Company’sThe Board of Directors, effective as of the 2016 Annual Meeting, the Boardhas determined that the appointment of an independent Chairman would beat this time is the most appropriate leadership structure.structure for the Company, taking into account the current business conditions and the environment in which the Company operates. Mr. Schlanger has beenwas first elected as Chairman of the Board effectivein January 28, 2016, subject to his election as a Director.2016. The Board believescontinues to believe that the Company is best served by having Mr. Schlanger as independent ChairChairman due to his unique,in-depth knowledge of the Company’s corporate strategy and operating history and by virtue of his experience as the Company’s Presiding Director since 2011.Director.

Senior managementWe believe that the leadership structure of the Company is responsible for assessing and managing risk. Senior management has developedour Board supports its effective oversight of our risk management. Our Board takes an enterpriseactive role in risk management, process intendedfulfilling its oversight responsibilities directly and through delegation to identify, prioritizethe Audit Committee, the Corporate Governance Committee, the Compensation and monitor keyManagement Development Committee and the Safety, Environmental and Regulatory Compliance Committee of those risks that may affectwithin their areas of responsibility and expertise, with the Company. OurChair of each Committee reporting to the Board on his or her respective committee’s oversight activities and

decisions. The Board also plays an important role in overseeing management’s performance of these functions. In addition to general risk oversight by the Board, the charter of the Audit Committee sets

| Committee | Risk Oversight | |

| Provides oversight of the Company’s enterprise risk management policies and processes, including major risk exposures, risk mitigation and the design and effectiveness of the Company’s processes and controls to prevent and detect fraudulent activity. | |

Compensation & Management Development | Provides oversight of the Company’s compensation programs for our employees, including executive officers, to ensure that the programs do not encourage employees to take unnecessary or excessive risks. | |

Corporate Governance | Provides oversight of corporate governance matters, such as director independence and director succession planning, to ensure overall Board effectiveness. | |

Safety, Environmental and Regulatory Compliance | Provides oversight responsibility for the review of programs, procedures, initiatives and training related to safety, environmental and regulatory compliance for the Company’s domestic and international business units, as well as the review of policies and programs to promote cyber security and to mitigate cyber security risks. | |

Our businesses are subject to a number of risks and uncertainties, which are described in detail in our Annual Report on Form10-K for the fiscal year ended September 30, 2015.2018. Throughout the year, in conjunction with its regular business presentations to the Board and its committees, management highlights significant risks and risk mitigation plans. Management also reports to each of the Committees and the Board on steps being taken to enhance management processes and controls in light of evolving market, business, regulatory and other conditions. The Chair of each Committee reports toBoard reviews the entire Board on their respective committee’s activitiesrisks facing the Company with both an annual and decisions.longer-term strategic focus. In addition, on an annual basis, an extended meeting of the Board is dedicated to reviewing the Company’s short- and long-term strategies and objectives, including consideration of significant risks to the execution of those strategies and the achievement of the Company’s objectives.

The Board of Directors held 816 meetings in Fiscal 2015.2018. All Directors attended at least 75 percent of the meetings of the Board of Directors and Committees of the Board of which they were members. Generally, all Directors are expected to attend the Company’s Annual Meeting of Shareholders, and eachabsent unforeseen circumstances that prevent their attendance. Each of the Company’s Directorsthen current Board members attended the 20152018 Annual Meeting of Shareholders.

Independent Directors of the Board also meet in regularly scheduled sessions without management. These sessions are led by our Presiding Director.Chairman.

Annually, the Corporate Governance Committee monitors and assesses the structure, composition, operationsoperation and performance of the Board and, if appropriate, makes recommendations for changes. Our Board Committees include Audit, Compensation and Management Development, Corporate Governance, Executive, and Safety, Environmental and Regulatory Compliance. The members of each of the Board Committees, with the exception of the Executive Committee, are independent as defined by the New York Stock Exchange listing standards. The charters of the Audit, Corporate Governance, Compensation and Management Development, and Safety, Environmental and Regulatory Compliance Committees can be found on the Company’s website,www.ugicorp.com,, under Investor Relations, Corporate Governance, or in print, free of charge, upon written request.

|

|

|

|

| ||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

|

|

|

| Current Board Composition | ||||||||||||

| Name | Audit Committee | Compensation and Development | Corporate Committee | Executive Committee | Safety, Environmental and Regulatory Compliance | |||||||

M. S. Bort | 1, 2 | Chair |

|

|

|

| ||||||

T. A. Dosch | 1, 2 | X |

|

|

|

| ||||||

R. W. Gochnauer | 1 |

| X | X |

|

| ||||||

A. N. Harris | 1 |

|

|

|

| X | ||||||

F. S. Hermance | 1 |

| X | X |

| Chair | ||||||

A. Pol | 1 |

| Chair |

| X | X | ||||||

M. O. Schlanger | 1, 3 |

|

| Chair | Chair |

| ||||||

J. B. Stallings, Jr. | 1 | X |

|

|

| X | ||||||

J. L. Walsh |

|

|

| X |

| |||||||

NUMBER OF COMMITTEE MEETINGS HELD LAST YEAR | 10 | 6 | 4 | 0 | 4 | |||||||

(1) Independent Director (2) Audit Committee Financial Expert (3) Chairman of the Board

- 12 -

Audit Committee

The Audit Committee (i) oversees the Company’s accounting and financial reporting processes and independent audits of the financial statements; (ii) oversees the adequacy of internal controls relative to financial and business risk; (iii) monitors compliance with enterprise risk management policies; (iv) appoints, and approves the compensation of, the independent accountants; (v) monitors the independence of the independent registered public accounting firm and the performance of the independent accountants and the internal audit function; (vi) discusses with management, the general auditor and the independent auditor, policies with respect to risk assessment and risk management; (vii) provides a means for open communication among the Company’s independent accountants, management, internal audit staff and the Board; and (viii) oversees compliance with applicable legal and regulatory requirements.

TheOur Board has determined that alleach member of the Audit Committee membersis considered to be financially literate under applicable New York Stock Exchange listing standards. Additionally, the Board has determined that Ms. Bort and Mr. Dosch qualify as “audit committee financial experts” in accordance with the applicable rules and regulations of the SEC.

MEETINGS HELD LAST YEAR: 9

Compensation and Management Development Committee

The Compensation and Management Development Committee (i) establishes and reviews overall executive compensation philosophy and objectives; (ii) reviews and approves corporate goals and objectives relevant to the CEO’s compensation, evaluates the CEO’s performance in light of those goals and objectives and, together with the other independent Directors, on the Board, determines and approves the CEO’s compensation based upon such evaluation; (iii) assists the Board in establishing a succession plan for the position of CEO; (iv) reviews the Company’s plans for management development and senior management succession; (v) establishes executive compensation policies and programs, ensuring that such plans do not encourage unnecessary risk-taking; (vi) approves salaries, target bonus levels, and awards and payments to be made to senior executives (other than the CEO); (vii) reviews with management the CD&A; (viii) oversees compliance with the Company’s recoupment policy; (ix) oversees compliance with the Company’s stock ownership policy; and (ix)(x) selects and oversees the performance of the compensation consultant, ensuring such consultant’s independence.

MEETINGS HELD LAST YEAR: 5

Corporate Governance Committee

The Corporate Governance Committee (i) identifies nominees and reviews the qualifications of persons eligible to stand for election as Directors and makes recommendations to the Board; (ii) reviews and recommends candidates for committeeCommittee membership and chairs; (iii) advises the Board with respect to significant developments in corporate governance matters; (iv) reviews and assesses the performance of the Board and each Committee; (v) reviews and recommends Director compensation; and (vi) reviews director and officer indemnification and insurance coverage.

MEETINGS HELD LAST YEAR: 4

Safety, Environmental and Regulatory Compliance Committee

The Safety, Environmental and Regulatory Compliance Committee (i) reviews the adequacy of, and provides oversight with respect to, the Company’s safety, environmental and regulatory compliance policies, programs, procedures, initiatives and training; (ii) reviews operational risks associated with the Company’s international businesses; (iii) reviews the Company’s policies and programs to promote cyber security; (iv) reviews reports regarding the Company’s code of ethical conduct for employees to the extent relating to safety, environmental and regulatory compliance matters; and (v) keeps abreast of the regulatory environment within which the Company operates.

MEETINGS HELD LAST YEAR: 4

- 13 -

Executive Committee

The Committee has limited powers to act on behalf of the Board of Directors between regularly scheduled meetings on matters that cannot be delayed.

MEETINGS HELD LAST YEAR: 0

Compensation Committee Interlocks and Insider Participation

The members of the Compensation and Management Development Committee are Messrs. Schlanger, Hermance and Jones and Mrs. Pol. None of the members is a former or current officer or employee of the Company or any of its subsidiaries, or is an executive officer of another company where an executive officer of UGI Corporation is a director.

The Corporate Governance Committee conducts an annual assessment of the composition of the Board and Committees and reviews with the Board the appropriate skills and characteristics required of Board members. The Committee seeks director candidates based upon a number of qualifications, including independence, knowledge, judgment, character, leadership skills, education, experience, financial literacy, standing in the community and the ability to foster a diversity of backgrounds and views and to complement the Board’s existing strengths.strengths, recognizing that diversity is a critical element to enhancing board effectiveness. The Committee continuously evaluates these desired attributes in light of the Company’s strategy and needs as part of its Director succession planning process. The Committee seeks individuals who have a broad range of demonstrated abilities and accomplishments in areas of strategic importance to the Company, such as general management, finance, energy distribution, international business, law and public sector activities. Directors should also possess a willingness to challenge and stimulate management and the ability to work as part of a team in a collegial atmosphere. The Committee also seeks individuals who are capable of devoting the required amount of time to serve effectively on the Board and its Committees. With respect to incumbent Directors, the Committee also considers the past performance of the Director on the Board.each Director. As part of the annual process of nominating independent Board candidates, the Committee obtains an opinion of the Company’s General Counsellegal counsel that there is no reason to believe that the Board candidate is not “independent” as defined by the New York Stock Exchange listing standards.

The Corporate Governance Committee considers recommendations from a wide variety of its business contacts, including current non-management Directors, executive officers, community leaders, and shareholders as a source for potential Board candidates. The Committee may also utilizeuses the services of a third-party search firmfirms to assist it in identifying and evaluating possible nominees for director.Director. The Board reviews and has final approval of all potential directorDirector nominees for election to the Board. During Fiscal 2015,2018, the Board of Directors, upon recommendation ofby the Corporate Governance Committee, elected James B. Stallings, Jr.Alan N. Harris as a member of the Board.Board, and selected Kelly A. Romano as a director-nominee to stand for election at the 2019 Annual Meeting of Shareholders. Mr. Stallings’ biographyHarris’ and Ms. Romano’s biographies and qualifications are set forth in ITEM 1 – ELECTION OF DIRECTORS,Election of Directors, beginning on page 6. In selecting Mr. Harris and Ms. Romano, the Corporate Governance Committee and the Board considered the overall diversity, skills and qualifications of the Board as a whole as well as the Company’s strategic direction and director succession planning.

WrittenShareholders may submit written recommendations by shareholders for director nominees should be submitteddirector-nominees to the Corporate Secretary, UGI Corporation, 460 North Gulph Road, King of Prussia, PA 19406. The Company’s Bylaws do not permit shareholders to nominate candidates from the floor at an annual meeting without notifying the Corporate Secretary 45 days prior to the anniversary of the mailing date of the Company’s proxy statement for the previous year’s annual meeting. Notification must include certain information detailed in the Company’s Bylaws. If you intend to nominate a candidate from the floor at the annual meeting,Annual Meeting, please contact the Corporate Secretary.

Director Stock Ownership GuidelinesBoard Evaluation Process

The Board is committed to a comprehensive annual performance self-assessment process, which seeks to determine whether it and its Committees function effectively. This self-assessment process is also linked with the Board’s long-term succession planning practices and Board refreshment, generally. The Corporate Governance Committee is responsible for overseeing this formal process with the assistance of Directors has a policyoutside counsel. Each year, the Committee reviews the overall evaluation process, as well as the substantive matters to be addressed by the evaluation process, with the goal to identify opportunities for improvement, as appropriate. The results of the assessments, which are collected and summarized by outside counsel, are discussed with the Committees and with the full Board. Any items requiring Directors to own Company common stock, together with stock units, in an aggregate amount equal to five timesadditional consideration are monitored by the Director’s annual cash retainer, and to achieveCorporate Secretary throughout the target level of common stock ownership within five years after joining the Board.

- 14 -

Code of Ethicssubsequent year forfollow-up action, as appropriate.

The Company has also adopted (i)Board evaluation process is conducted, in alternating years, by either a Codewritten questionnaire or by a series of Ethicsinterviews conducted by the independent Chair. During Fiscal 2018, each Director completed a written questionnaire regarding the effectiveness of the Board and each committee on which the Director serves. Outside counsel received the completed questionnaires, compiled the results and prepared a summary. The summary is used as a basis for discussion by each of the Chief Executive Officercommittees and Senior Financial Officers that appliesthe Board in identifying opportunities for improvement or suggestions for improving the effectiveness of the Board, as well as identifying changes to the Company’s Chief Executive Officer, Chief Financial OfficerBoard’s policies and Chief Accounting Officer, and (ii) a Code of Business Conduct and Ethics for Directors, Officers and Employees. Both Codes are posted onprocedures in order to best enable the Company’s website,www.ugicorp.com, under Investor Relations – Corporate Governance. All of these documents are also available free of charge by writingBoard to the Treasurer of UGI Corporation at P.O. Box 858, Valley Forge, PA 19482.discharge its oversight responsibilities.

UGI seeks regular engagement with investors in order to communicate our strategy and to solicit feedback from the investorinvestment community. Management periodically engages a third partythird-party consultant to obtain independent feedback from our investors. In Fiscal 2015,2018, we participated in a number of investor conferences, roadshows, meetings at our corporate office, and telephonic discussions with investors. These meetings occurred both in the United States and in Europe and were attended by various members of the Company’s senior management, including our Chief Executive Officer, Chief Financial Officer, Treasurer, and/or senior members of our business segmentunit management teams. Management periodically discusses feedback, including key themes and other insights gained from the investor outreach meetings, at the Company’s Board and Committee meetings, as appropriate. The Board of Directors, as well as the management team, values the perspectives of our investors as it helps us to understand and evaluate the effectiveness of our investor communications. Additionally, the Compensation and Management Development Committee takes into consideration the results of the annual advisory vote on the Company’s executive compensation program. At the 20152018 Annual Meeting, over 96%94% of the Company’s shareholders showed their strong support by voting to approve the compensation of the Company’s named executive officers.

The Company has adopted (i) a Code of Ethics for the Chief Executive Officer and Senior Financial Officers that applies to the Company’s Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer, and (ii) a Code of Business Conduct and Ethics for Directors, Officers and Employees. Both Codes are posted on the Company’s website, www.ugicorp.com, under Investor Relations – Corporate Governance. All of these documents are also available free of charge by writing to the Treasurer of UGI Corporation at P.O. Box 858, Valley Forge, PA 19482.

Compensation Committee Interlocks and Insider Participation

The current members of the Compensation and Management Development Committee are Mrs. Pol and Messrs. Gochnauer and Hermance. Roger B. Vincent, a director until his retirement in January 2018, was a member of the Compensation and Management Development Committee during a portion of Fiscal 2018. None of the members is a former or current officer or employee of the Company or any of its subsidiaries, or is an executive officer of another company where an executive officer of UGI Corporation is a director.

You may contact the Board of Directors, an individual non-management director,independent Director, or the non-managementindependent Directors as a group by writing to them c/o UGI Corporation, P.O. Box 858, Valley Forge, PA 19482. These contact instructions have been posted on the Company’s website atwww.ugicorp.com under Investor Relations – Corporate Governance.

Any communications directed to the Board of Directors, an individual non-management director,independent Director, or the non-managementindependent Directors as a group from employees or others that concern complaints regarding accounting, financial statements, internal controls, ethical or auditing matters will be handled in accordance with procedures adopted by the Audit Committee.

All other communications directed to the Board of Directors, an individual non-management director,independent Director, or the non-managementindependent Directors as a group are initially reviewed by the Corporate Secretary. In the event the Corporate Secretary has any question as to whether the directorsDirectors should be made aware of any issue raised, the Corporate Secretary shall be entitled to consult with the Chair of the Board in making such determination. The Corporate Secretary will distribute communications to the Board, an individual director, or to selected directors, depending on the content of the communication. The Corporate Secretary maintains a log of all such communications that is available for review for one year upon request of any member of the Board.

Typically, we do not forward to our Board communications from our shareholders or other parties that are of a personal nature or are not related to the duties and responsibilities of the Board, including, but not limited to, junk mail and mass mailings, resumes and other forms of job inquiries, opinion surveys and polls and business solicitations or advertisements.

- 15 -

| |

The table below shows the components of director compensation for Fiscal 2015.2018. A Director who is an officer or employee of the Company or its subsidiaries is not compensated for service on the Board of Directors or on any Committee of the Board.

| Director Compensation Table – Fiscal 2015 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Director Compensation Table – Fiscal 2018 | Director Compensation Table – Fiscal 2018 |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Name |

| Fees Earned or Paid in Cash ($)(1) |

|

| Stock Awards ($)(2) |

|

| Option Awards ($)(3) |

|

| Non-Equity Incentive Plan Compensation ($) |

|

| Change in Pension Value And Nonqualified Deferred Compensation Earnings ($)(4) |

|

| All Other Compensation ($) |

|

| Total ($) |

| | Fees Earned or Paid in Cash ($)(1) |

| | Stock Awards ($)(2) |

| | Option Awards ($)(3) |

| | Non-Equity Incentive Plan Compensation ($) |

| | Change in Pension Value And Nonqualified Deferred Compensation Earnings ($)(4) |

| | All Other Compensation ($) |

| | Total ($) |

| ||||||||||||||

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) |

(b) |

(c) |

(d) |

(e) |

(f) |

(g) |

(h) | ||||||||||||||||||||||||||||||||||||||||||

M. S. Bort | 82,000 | 160,271 | 60,143 | 0 | 0 | 0 | 302,414 |

|

100,000 |

|

|

179,527 |

|

|

68,162 |

|

|

0 |

|

|

0 |

|

|

0 |

|

|

347,689 |

| ||||||||||||||||||||||||||||

T. A. Dosch |

|

87,500 |

|

|

143,400 |

|

|

68,162 |

|

|

0 |

|

|

0 |

|

|

0 |

|

|

299,062 |

| |||||||||||||||||||||||||||||||||||

R. W. Gochnauer | 82,000 | 153,062 | 60,143 | 0 | 0 | 0 | 295,205 |

|

90,000 |

|

|

170,235 |

|

|

68,162 |

|

|

0 |

|

|

0 |

|

|

0 |

|

|

328,397 |

| ||||||||||||||||||||||||||||

L. R. Greenberg | 356,667 | 0 | 0 | 0 | 0 | 0 | 356,667 | |||||||||||||||||||||||||||||||||||||||||||||||||

A. N. Harris |

|

45,918 |

|

|

109,500 |

|

|

52,412 |

|

|

0 |

|

|